All Categories

Featured

Table of Contents

- – The Only Guide for How Modern Tools Is Making ...

- – The Only Guide for Unexpected Charges to Avoid

- – Getting My Everything Must Prepare For Throug...

- – How Specialty Counseling Services : APFSC Tai...

- – The 8-Minute Rule for Assessing Specialty Co...

- – Facts About Restoring Your Credit Score Foll...

Some banks are more going to provide negotiations or hardship programs than others. Obtaining charge card financial debt forgiveness is not as straightforward as requesting your balance be gotten rid of. It calls for preparation, documents, and negotiation. Creditors do not conveniently provide financial debt mercy, so recognizing how to present your case effectively can enhance your chances.

I wish to talk about any kind of alternatives available for minimizing or resolving my debt." Financial debt mercy is not an automatic option; oftentimes, you have to bargain with your lenders to have a section of your balance minimized. Charge card firms are frequently available to negotiations or partial mercy if they think it is their finest chance to recover a few of the cash owed.

The Only Guide for How Modern Tools Is Making Financial Help Easier

If they supply complete mercy, obtain the contract in writing prior to you accept. You could need to submit an official written demand discussing your challenge and exactly how much mercy you need and give documentation (see following area). To bargain properly, attempt to comprehend the financial institutions position and use that to provide a solid instance as to why they must work with you.

Always ensure you get verification of any kind of mercy, negotiation, or challenge plan in composing. Financial institutions might offer less alleviation than you need.

Debt forgiveness entails lawful considerations that customers must be aware of prior to proceeding. The complying with government laws aid protect consumers looking for debt forgiveness: Restricts harassment and abusive debt collection techniques.

The Only Guide for Unexpected Charges to Avoid

Needs lenders to. Restricts financial debt negotiation business from billing in advance fees. Comprehending these protections assists prevent scams and unreasonable creditor techniques.

This time framework varies by state, normally between 3 and 10 years. Once the statute of restrictions runs out, they typically can't sue you anymore. However, making a payment or perhaps recognizing the debt can reactivate this clock. Also, also if a lender "charges off" or crosses out a financial debt, it does not imply the debt is forgiven.

Getting My Everything Must Prepare For Throughout the Debt Forgiveness Process To Work

Prior to accepting any type of settlement strategy, it's an excellent idea to inspect the statute of limitations in your state. Legal ramifications of having financial obligation forgivenWhile financial debt mercy can relieve monetary problem, it features possible lawful consequences: The internal revenue service deals with forgiven financial obligation over $600 as gross income. Consumers obtain a 1099-C kind and needs to report the quantity when filing taxes.

Right here are several of the exemptions and exemptions: If you were bankrupt (meaning your complete financial debts were more than your overall properties) at the time of mercy, you might exclude some or every one of the canceled financial obligation from your gross income. You will certainly require to complete Type 982 and affix it to your tax obligation return.

While not associated with bank card, some trainee funding mercy programs enable debts to be terminated without tax obligation consequences. If the forgiven financial obligation was connected to a qualified ranch or organization procedure, there might be tax obligation exemptions. If you don't get debt forgiveness, there are alternate debt alleviation strategies that might work for your scenario.

How Specialty Counseling Services : APFSC Tailored Financial Support Providers Operate with Clients Fundamentals Explained

You obtain a new funding big enough to repay all your existing charge card equilibriums. If accepted, you utilize the new car loan to settle your credit scores cards, leaving you with simply one regular monthly settlement on the debt consolidation financing. This streamlines financial debt monitoring and can conserve you cash on interest.

Crucially, the agency discusses with your creditors to lower your passion prices, dramatically decreasing your total financial debt concern. DMPs may also reduce or remove late fees and penalties. They are a great financial obligation service for those with inadequate credit report. When all other alternatives stop working, insolvency might be a feasible path to removing frustrating bank card financial obligation.

Allow's encounter it, after several years of higher prices, cash doesn't go as far as it utilized to. About 67% of Americans claim they're living income to paycheck, according to a 2025 PNC Bank study, which makes it hard to pay for debt. That's specifically real if you're bring a big debt balance.

The 8-Minute Rule for Assessing Specialty Counseling Services : APFSC Tailored Financial Support Providers to Find the Ideal Fit

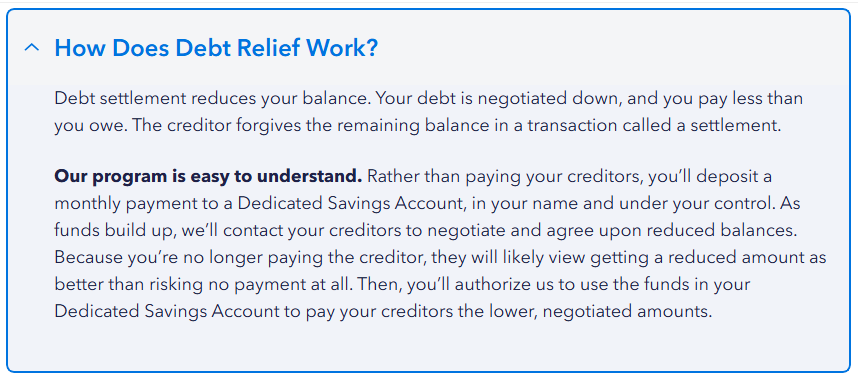

Loan consolidation finances, financial debt administration plans and settlement approaches are some methods you can make use of to lower your financial obligation. If you're experiencing a major financial hardship and you've worn down other choices, you might take an appearance at debt forgiveness. Financial debt forgiveness is when a lending institution forgives all or some of your impressive balance on a car loan or other charge account to help alleviate your debt.

Debt forgiveness is when a loan provider agrees to clean out some or all of your account balance. It's a technique some people make use of to reduce debts such as credit rating cards, personal lendings and student finances.

Federal trainee car loan forgiveness programs are among the only ways to remove a financial obligation without consequences. These programs use only to government pupil fundings and often have strict qualification regulations. Private pupil loans do not get approved for forgiveness programs. One of the most popular choice is Civil service Car Loan Mercy (PSLF), which eliminates staying federal car loan equilibriums after you work full-time for a qualified employer and make payments for ten years.

Facts About Restoring Your Credit Score Following Specialty Counseling Services : APFSC Tailored Financial Support Uncovered

That indicates any type of nonprofit medical facility you owe might have the ability to give you with debt alleviation. Over half of all U.S. healthcare facilities use some type of clinical debt alleviation, according to client services promote team Buck For, not just nonprofit ones. These programs, frequently called charity treatment, minimize or even remove medical expenses for certified people.

Table of Contents

- – The Only Guide for How Modern Tools Is Making ...

- – The Only Guide for Unexpected Charges to Avoid

- – Getting My Everything Must Prepare For Throug...

- – How Specialty Counseling Services : APFSC Tai...

- – The 8-Minute Rule for Assessing Specialty Co...

- – Facts About Restoring Your Credit Score Foll...

Latest Posts

Financial Consequences the Cost of Bankruptcy Counseling for Dummies

Some Known Incorrect Statements About Why Avoiding to Seek Rebuild Credit While Paying Off Medical Loans Causes Things Worse

The smart Trick of Developing Your Financial Recovery Plan That Nobody is Discussing

More

Latest Posts

Financial Consequences the Cost of Bankruptcy Counseling for Dummies

Some Known Incorrect Statements About Why Avoiding to Seek Rebuild Credit While Paying Off Medical Loans Causes Things Worse

The smart Trick of Developing Your Financial Recovery Plan That Nobody is Discussing